The following walkthrough describes how to:

- Validate an invoice that has been uploaded via email or Document Uploader.

- Send the invoice to the customer for review and acceptance

Step 1) You already uploaded a pdf document, either:

- via the Document Uploader (see the following guide), or

- via email (see the following guide).

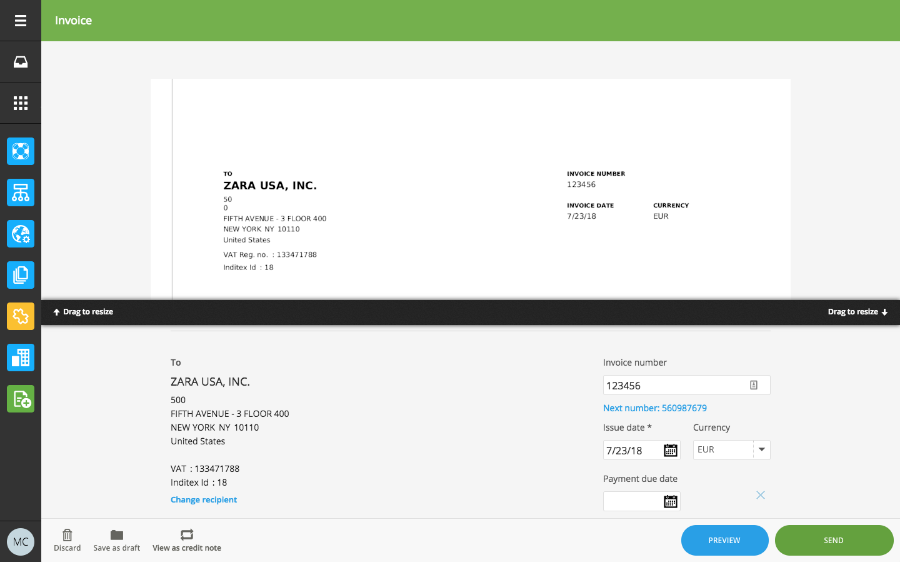

Step 2) When viewing the document, the top half of the screen is a display of your original invoice.

The bottom half is the scanned Tradeshift version of the invoice with an extract and representation of the relevant data from the original invoice.

Step 3) Review all required fields on the invoice – making sure you complete all mandatory fields (marked with an *).

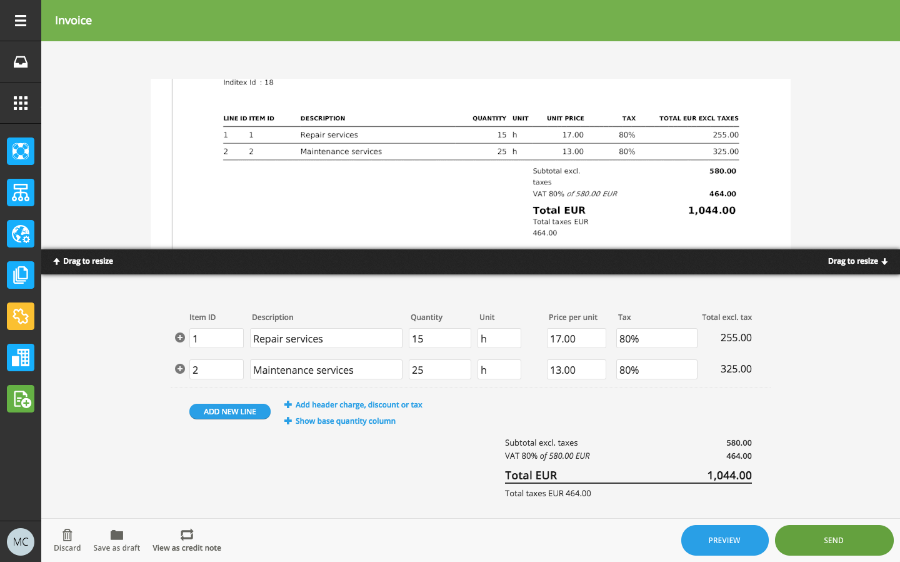

Check that all the values are correct at header and line level:

Important note: Inditex does not strictly require line level detail in the invoices that are submitted to their business entities. Therefore, when validating a transcribed document, keep in mind that it is sufficient to have a summary invoice line with the total invoice amount and tax amount - this practice speeds up the validation process.

Step 4) Once you are satisfied that all information is correct, send the invoice to the customer. The invoice will then be forwarded to the customer for review and acceptance:

Important notes:

- If any fields which are mandatory, are not completed, it will not be possible to send your invoice and you will receive a warning indicating what needs to be completed.

- If you have any attachments to the invoice, remember to attach it, before sending the invoice to the customer.